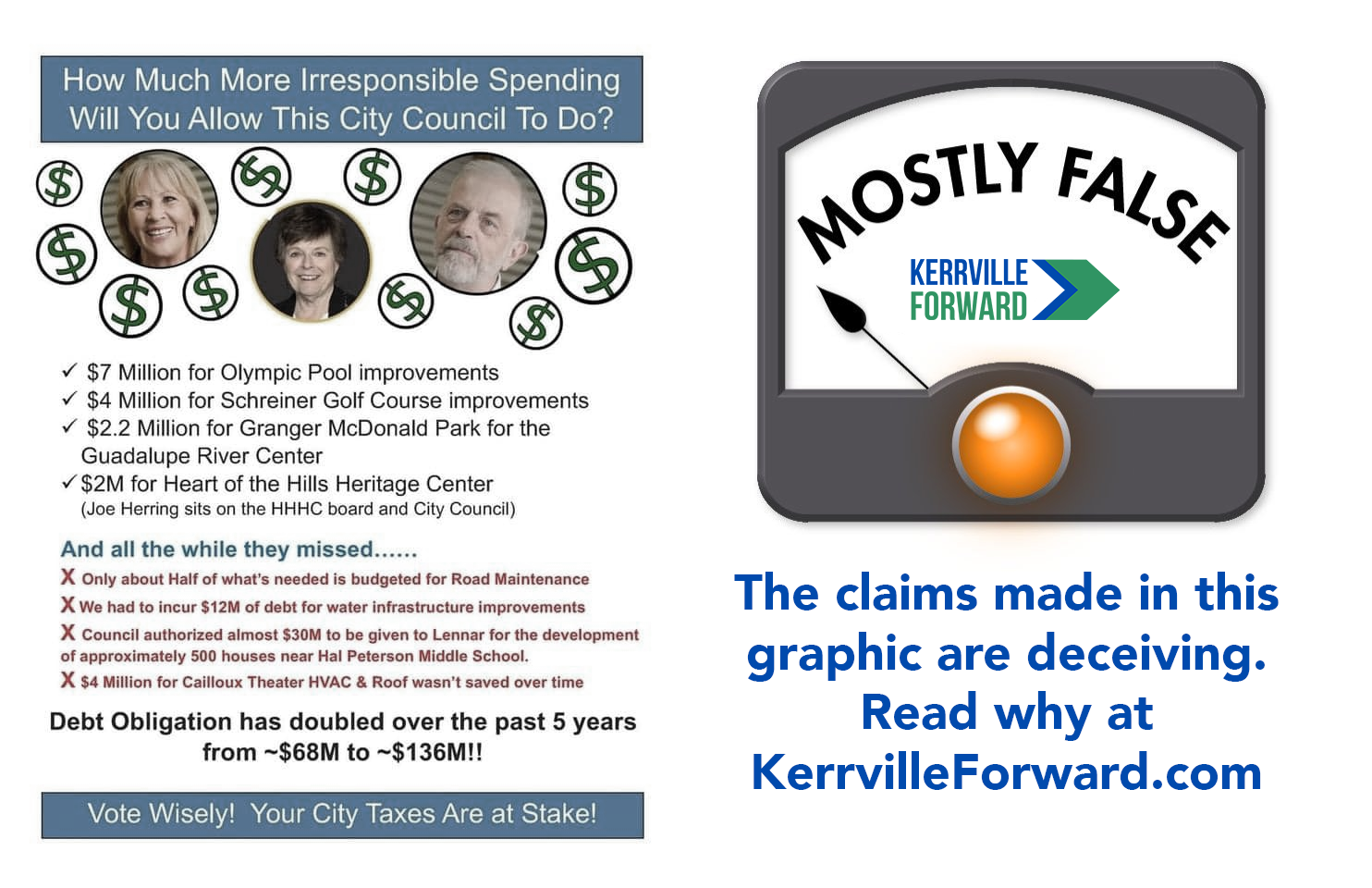

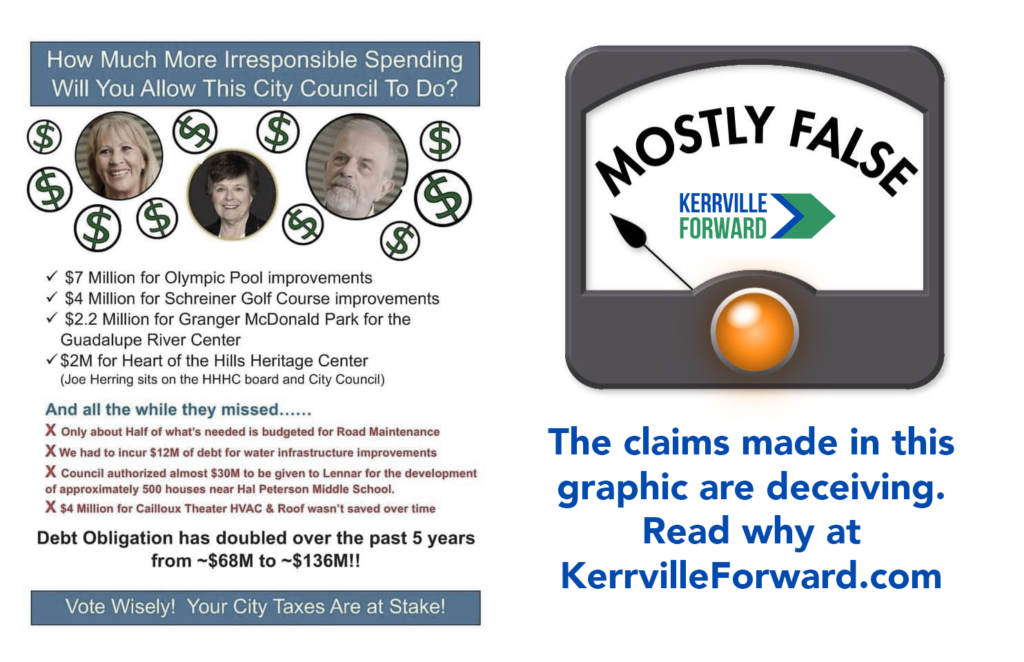

A graphic has been circulating on social media that is full of misrepresentations. Here is the truth behind these claims along with sources to help you gather your own information.

The Truth:

Quality of Life Projects

The claims made next to the checkmarks (olympic pool, golf course, park, and heritage center) are misleading. The money allocated to pay for these improvements came from the City’s Economic Improvement Corporation (EIC) that is OBLIGATED to spend 4B sales tax dollars on a few categories of projects, including “quality of life” projects. The funds used to pay for these improvements will come from sales tax dollars as part of a program that voters enacted in the 1990s. These funds WILL NOT come from your property taxes, and no tax increase was enacted to make these projects happen.

Road Maintenance

The City has an extensive road maintenance program in place that uses hard data to plan for paving and other improvements as needed. The 2024 budget includes a priority: “Focus on ongoing streets maintenance and reconstruction efforts, including updating the Pavement Master Plan.” The budget continues later, “Streets maintenance also remains a top priority in FY2024 with a budget of $2M (not including CIP). The City updated the Pavement Condition Assessment in FY2023 and will be presenting the new Pavement Master Plan in FY2024.”

Sources:

https://www.kerrvilletx.gov/DocumentCenter/View/43272/FY24-Budget-in-Brief-

Water and Sewer Debt Service

Just as any massive utility company must do, the City (which owns all of the water and sewer infrastructure in Kerrville) has to upgrade and replace equipment from time to time to ensure quality of service and safety. And just as a homeowner sometimes has to take on debt for huge home renovation projects, the city takes on debt to finance these efforts. All of the utility infrastructure debt is paid for out of water and sewer revenues — NOT through property taxes. Rate payers share the expense for upgrades and the debt service on those upgrades when they pay their utility bill each month. Rate payers include residents, but also businesses and other institutions that use huge portions of the water and sewer service.

Lennar Homes

Lack of affordable housing is the number one issue for thousands of residents of Kerrville. Housing supply and housing costs are barriers to home ownership for so many local residents. “The lack of affordable housing causes employees to commute to Kerrville for work and lends itself to an unstable workforce and thereby limits economic growth and development in the area,” the Hill Country Community Journal reported in January.

Housing was identified as a major focus in the Kerrville 2050 comprehensive plan and has been a priority of city government since that time.

Before Lennar, the city and the taxpayers owned a cedar-covered hillside on Looop 534 that raised no tax revenue and had no economic benefit to the community. Now, that piece of land is home to numerous tax-paying residents that are actively contributing to the community, its economy, and paying taxes to not only the city, but all of the other taxing entities in Kerr County, such as school taxes, county taxes, and more.

Lennar was not “given” $30 million for the development of homes. For the first phase of the attainable housing development, Lennar received some city land in exchange for building the subdvision and offering the houses for a certain price point — one in range of the median income workers of Kerrville.

In the second phase, a TIRZ (Tax Increment Reinvestment Zone) was created that will benefit Lennar. This means that as the property develops and sells, some of the property tax revenue *increase* will be shared with Lennar to offset their massive infrastructure costs associated with this housing project. That is, over a period of a decade, Lennar will be partially reimbursed for their infrastructure that they build out and donate to the city for this subdivision.

None of your property taxes have gone to fund Lennar’s development. The city will still receive increased tax revenue for the development when complete. And this arrangement is no handout. Lennar is required to meet certain obligations to continue to receive this benefit.

Why weren’t these arrangements offered to a local builder instead? In short, they were. No local builders are able to meet the obligation of completing so much infrastructure, so many homes, at such a low price point, over such a small period of time. If a local builder had presented a proposal that met the needs of the community, council members have stated that they’d prefer the local builder. We just don’t have builders on this scale in Kerrville.

Source: https://www.hccommunityjournal.com/article_b537fb80-bfc8-11ee-b96b-678d6f4d98a9.html

City Debt

The graphic claims that debt obligation has doubled over the past five years from $68 million to $136 million.

Recently the city put out documentation explaining the structure and form of the debt that it has incurred. This chart directly contradicts the claims in the Facebook graphic above. Key takeaways are as follows…

- More than half of the city’s current debt is paid for by either sales tax revenue or water/sewer revenues and NOT property taxes

- An increase of $45 million in debt was endorsed by the voters to pay for the public safety facility, which will house police and fire infrastructure.

- The city still has one of the highest bond ratings available to small municipalities — an AA rating from Standard & Poors. This credit ranking agency carries far more weight than anonymous flyers posted on social media.

Here is the chart from the city: